What are business valuation services in the United States?

Business valuation services in the United States refers to professional assessments that determine a company's economic worth through systematic analysis of financial performance, market conditions, and risk factors. These services employ standardized methodologies recognized by regulatory bodies including the IRS, DOL, SBA, SEC, and FINRA to establish credible, defendable valuations.

Valuation professionals utilize three primary approaches: the income approach (discounted cash flow analysis or capitalization of earnings method), market approach (comparable company analysis and precedent transaction analysis), and asset approach (net asset value calculations). Each methodology considers different value drivers including EBITDA multiples, revenue growth patterns, market position, and operational risk factors.

The scope encompasses various valuation contexts requiring specialized expertise:

Financial Reporting Valuations:

1. Purchase Price Allocation (ASC 805) – Allocating acquisition costs to acquired assets and liabilities

2. Equity-Based Compensation (ASC 718) – Valuing stock options and equity awards for financial statements

3. Impairment Testing (ASC 350/360) – Assessing goodwill and asset impairment for reporting compliance

4. Fair Value Measurements – Determining fair values for various financial reporting requirements

5. Embedded Derivative Analysis – Identifying and valuing complex financial instruments

Tax and estate planning applications require specific methodologies that consider discounts for lack of control and discounts for lack of marketability minority interests. These valuations must withstand IRS scrutiny and support tax positions during audits or disputes.

Mergers and acquisitions demand comprehensive due diligence and analysis that considers synergies, strategic value, and market dynamics. Investment bankers, private equity firms, and strategic acquirers rely on these assessments to structure transactions and negotiate deal terms effectively.

Why use business valuation services in the United States?

Professional valuation services provide objective, credible assessments that support critical business decisions and regulatory compliance requirements. Independent valuations eliminate bias and provide third-party validation that stakeholders, regulators, and courts recognize as authoritative.

Businesses face significant financial and legal risks when making valuation-dependent decisions without professional guidance. Tax authorities regularly challenge inadequately supported valuations, potentially resulting in penalties, interest charges, and additional tax liabilities that far exceed professional valuation costs.

Key Benefits:

1. Regulatory Compliance – Ensuring adherence to ASC 805, ASC 718, ASC 350, and tax regulations with defendable methodologies

2. Risk Mitigation – Reducing exposure to IRS challenges, litigation disputes, and regulatory violations through credible documentation

3. Strategic Decision Support – Providing actionable insights for M&A transactions, capital raises, and succession planning initiatives

4. Stakeholder Confidence – Building trust with investors, lenders, partners, and family members through transparent, professional analysis

5. Litigation Defense – Supporting legal positions with expert testimony and comprehensive valuation reports that withstand cross-examination

Sofer Advisors maintains subscriptions to major data aggregator databases and employs rigorous methodologies that courts and regulatory bodies consistently accept. This comprehensive approach ensures valuations serve their intended purpose while providing long-term defensibility.

The firm's team approach guarantees project continuity and quality consistency, unlike solo practitioners who may lack the resources or expertise to handle complex engagements. With 100% of Sofer Advisors revenue tied to business valuation services, the focus remains on delivering specialized expertise rather than treating valuations as secondary offerings.

How does business valuation services in the United States work?

The valuation process follows a structured methodology designed to ensure accuracy, compliance, and defensibility across all engagement types. Professional valuations require systematic data gathering, analysis, and reporting that meets industry standards and regulatory requirements.

Initial engagement begins with understanding the valuation purpose, standard of value required, and specific reporting needs. Different contexts require different approaches – estate planning valuations can differ significantly from financial reporting, financing, immigration or litigation support engagements.

Phase 1: Discovery and Data Collection

1. Identify valuation purpose and applicable standards

2. Gather historical financial statements and tax returns

3. Collect operational data and management projections

4. Review legal documents and ownership structures

5. Conduct management interviews and site visits

Phase 2: Financial Analysis and Benchmarking

6. Normalize historical financial performance

7. Analyze industry trends and market conditions

8. Develop financial projections and assumptions

9. Research comparable companies and transactions

10. Assess risk factors and competitive position

Phase 3: Valuation Application and Reporting

11. Apply appropriate valuation methodologies

12. Calculate discounts and premiums as applicable

13. Reconcile multiple approaches to final conclusion

14. Prepare comprehensive valuation report

15. Present findings and support conclusions

Technology integration enhances efficiency and security throughout the process. Platforms like TaxDome manage project workflows and client communications, while Suralink provides encrypted data collection that protects sensitive financial information.

The collaborative approach involves regular communication with clients, their advisors, and other stakeholders to ensure alignment and understanding. This educational mindset helps clients comprehend the valuation process and apply insights to their strategic decision-making.

What types of business valuation services are there in the United States exist?

Business valuation services encompass diverse specializations addressing specific business contexts, regulatory requirements, and stakeholder needs. Each service type employs tailored methodologies and reporting formats designed for particular use cases.

Corporate finance and M&A valuations support strategic transactions including buy-sell agreements, fairness opinions, and ESOP implementations. These engagements often involve complex deal structures and require extensive due diligence to identify synergies and integration risks.

Tax and Estate Planning Services:

– 409A Valuations/83b Elections – Common stock valuations for startup equity compensation and the establishment of incentive plans

– Estate and Gift Tax – Family limited partnership and gift valuations

– Basis Establishment – Determining tax basis for newly formed entities

– Entity Conversions – Supporting tax-free reorganizations and structure changes

– Personal Goodwill – Separating individual from corporate goodwill for tax optimization

– Qualified Opportunity Zones – Assisting in the tax computation of the lesser of the original deferred gain or the current fair market value of your qualified opportunity fund investment.

Financial reporting valuations ensure compliance with accounting standards and support audit requirements. Purchase price allocation engagements identify and value intangible assets acquired in business combinations, while impairment testing assesses goodwill and long-lived asset values.

Dispute resolution services provide objective analysis for shareholder conflicts, marital divorce proceedings, eminent domain and other litigation matters. Expert witness testimony supports legal positions and helps resolve valuation disagreements through credible, professional analysis.

Immigration investment valuations and business plans address E-2 and EB-5 visa requirements, ensuring investment amounts meet USCIS thresholds while supporting residency applications. These specialized engagements require understanding of both valuation principles and immigration regulations.

Financing valuations support bank lending, SBA applications, and venture capital fundraising by providing independent assessments that build lender and investor confidence in transaction valuations.

When should businesses seek valuation services United States?

Timing plays a crucial role in maximizing the value and utility of professional business valuations. Strategic planning benefits from regular valuation updates that track value creation initiatives and market condition changes.

Triggering events often necessitate immediate valuation needs. Mergers and acquisitions require current valuations for negotiation, due diligence, and transaction structuring. Partnership disputes, divorce proceedings, and estate planning deadlines create urgent needs for credible, defensible valuations.

Critical Timing Considerations:

🔹Annual financial reporting deadlines requiring ASC 805 or ASC 718 compliance

🔹 Tax filing deadlines for gift and estate tax returns

🔹 Transaction closing schedules demanding purchase price allocation completion

🔹 Litigation discovery deadlines or deposition, mediation, arbitration and trial dates requiring expert report submission

🔹 Financing application deadlines needing independent valuation support

Optimal Planning Windows:

🔹 Six months before anticipated M&A transactions

🔹 Quarterly updates for rapidly growing companies

🔹 Annual valuations for estate planning optimization

🔹 Biannual assessments for equity compensation programs

Market conditions significantly impact business values, making timing considerations essential for accurate assessments. Economic cycles, industry trends, and regulatory changes affect valuation multiples and risk assessments.

Proactive valuation planning provides strategic advantages including tax optimization opportunities, improved negotiation positions, and enhanced stakeholder communications. Regular valuations create baseline measurements that demonstrate value creation and support future transaction discussions.

Sofer Advisors' next business day response policy ensures clients can address time-sensitive valuation needs without compromising quality or thoroughness. This agility proves particularly valuable during competitive transaction processes or regulatory compliance deadlines.

Which valuation methods are most reliable?

Valuation methodology selection depends on business characteristics, available data, and the specific purpose of the engagement. Professional standards require consideration of multiple approaches to ensure comprehensive analysis and credible conclusions.

The income approach proves most reliable for profitable, mature businesses with predictable cash flows and stable operations. Discounted cash flow analysis captures a company's unique earning capacity and growth prospects while considering industry-specific risk factors.

Market approach methodologies provide strong support when comparable transactions and public company data exist. This approach reflects actual market behavior and investor sentiment, though adjustments for differences in size, profitability, and growth are essential.

Methodology Selection Framework:

| Business Stage | Primary Method | Secondary Method | Considerations |

|—————|—————|—————-|—————|

| Startup/Early | Asset Approach | Market Approach | Limited operating history |

| Growth | Income Approach | Market Approach | Volatile cash flows |

| Mature | Income Approach | Market Approach | Stable operations |

| Declining | Asset Approach | Income Approach | Impaired earning capacity |

Key Takeaways:

– Income approach best captures unique business characteristics and future potential

– Market approach provides external validation through comparable transaction analysis

– Asset approach serves as floor value for businesses with substantial tangible assets

Intangible asset valuations require specialized approaches including relief-from-royalty, excess earnings, and cost-to-recreate methodologies. These techniques address intellectual property, customer relationships, and workforce-in-place values essential for purchase price allocation engagements.

Professional judgment guides methodology weighting and final value conclusions. Experienced valuators consider data quality, market conditions, and engagement-specific factors when reconciling multiple approaches to final opinions.

How to choose business valuation services in the United States?

Selecting qualified valuation professionals requires evaluating credentials, experience, and service capabilities that match your specific needs and timeline requirements. Professional certifications and industry recognition provide initial screening criteria for identifying qualified providers.

Credentialing standards vary significantly among providers. Look for professionals holding multiple recognized certifications including ABV (Accredited in Business Valuation), ASA (Accredited Senior Appraiser), or CVA (Certified Valuation Analyst) designations that demonstrate specialized training and ongoing education requirements.

Top Selection Mistakes:

1. Choosing Based on Price Alone

– Problem: Lowest bidders often lack necessary expertise or cut corners on analysis

– Impact: Inadequate valuations face regulatory challenges and litigation risks

– Solution: Evaluate qualifications, methodology, and track record alongside pricing

2. Using Non-Specialized Providers

– Problem: CPAs or brokers treating valuation as secondary service lack depth

– Impact: Missing critical analysis components and industry-specific considerations

– Solution: Select firms where business valuation comprises majority of revenue

3. Ignoring Court Room Experience

– Problem: Providers lack litigation support and expert testimony experience

– Impact: Valuations cannot withstand challenge or cross-examination

– Solution: Verify expert witness qualifications and deposition history

4. Overlooking Technology and Security

– Problem: Inadequate data protection and inefficient communication systems

– Impact: Security breaches and project delays affecting critical deadlines

– Solution: Confirm encrypted data collection and professional project management systems

5. Selecting Solo Practitioners Without Backup

– Problem: No continuity plan if primary valuator becomes unavailable

– Impact: Project delays or abandonment during critical periods

– Solution: Choose firms with team-based approaches and W-2 equivalent employees

Service responsiveness indicates provider capabilities and client commitment. Firms offering next-business-day response policies demonstrate operational excellence and client-focused service delivery.

Data access and analytical capabilities distinguish professional providers from basic offerings. Comprehensive database subscriptions, advanced modeling software, and research capabilities enable thorough analysis and credible conclusions.

Frequently Asked Questions (FAQ)

What are business valuation services in the United States?

Business valuation services in the United States encompasses professional assessments determining company economic worth through systematic financial analysis, market research, and risk evaluation. These services provide credible, defendable valuations supporting critical decisions including mergers, acquisitions, tax planning, financial reporting, and dispute resolution. Qualified professionals employ standardized methodologies recognized by regulatory authorities.

How much do business valuation services cost in the United States?

Business valuation costs typically range from $5,000 to $50,000 depending on company complexity, valuation purpose, and timeline requirements. Simple operating company valuations for estate planning may cost $7,500 to $15,000, while complex purchase price allocations or litigation support engagements can exceed $25,000. Factors affecting pricing include revenue size, number of entities, intangible assets, and expert testimony requirements.

Why are certified business valuations important?

Certified business valuations provide regulatory compliance, legal defensibility, and stakeholder credibility essential for major business decisions. Tax authorities, courts, and regulatory bodies recognize professional valuations meeting industry standards, reducing audit risks and legal challenges. Independent certifications eliminate bias concerns while providing objective analysis supporting strategic transactions, estate planning, and financial reporting requirements.

What documents are needed for business valuation?

Business valuations require comprehensive documentation including three to five years of financial statements, tax returns, management projections, organizational charts, and customer contracts. Additional materials include industry reports, comparable transaction data, legal agreements, and operational metrics. Complete documentation ensures thorough analysis while incomplete records may limit valuation approaches and reduce conclusion reliability.

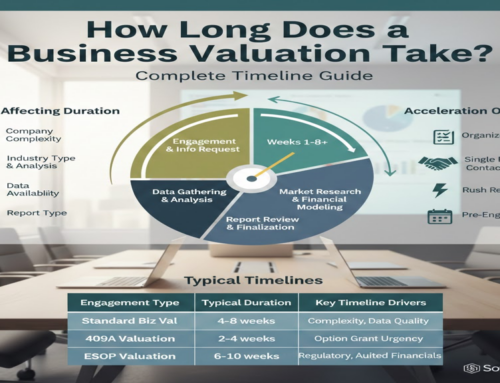

How long does business valuation take?

Standard business valuations typically require four to eight weeks from data collection through final report delivery. Complex engagements involving multiple entities, extensive intangible assets, or litigation support may extend eight to twelve weeks. Rush projects can be completed in one to three weeks with premium pricing. Timeline depends on client responsiveness, document availability, and analytical complexity.

What is the difference between appraisal and valuation?

Business appraisals and valuations are often used interchangeably but may differ in scope and purpose. Appraisals typically refer to formal assessments meeting specific regulatory or legal standards, while valuations can encompass broader analytical services. Both determine economic worth through professional analysis, though appraisals may require specific certifications or compliance with uniform standards depending on the jurisdiction.

Can business valuations be challenged?

Business valuations can be challenged by tax authorities, opposing parties, or stakeholders questioning methodology, assumptions, or conclusions. Professional valuations following industry standards and employing qualified appraisers typically withstand scrutiny better than informal assessments. Proper documentation, reasonable assumptions, and credible methodologies provide strong defense against challenges while inadequate analysis invites disputes.

What affects business value the most?

Financial performance, particularly EBITDA and revenue growth trends, most significantly impacts business value along with market position and competitive advantages. Risk factors including customer concentration, key person dependency, and industry dynamics also substantially affect valuations. Management quality, operational efficiency, and growth prospects influence investor perceptions and valuation multiples applied during analysis.

How often should businesses get valued?

Businesses should obtain valuations atleast annually for estate planning purposes, equity compensation programs and other purposes. Businesses should obtain valuations more frequently such as quarterly for rapidly growing companies, whom are approaching an IPO or exit event. Transaction-driven valuations occur as needed for mergers, acquisitions, or financing activities. Regular valuations track value creation initiatives while providing baseline measurements supporting strategic planning and stakeholder communications throughout business lifecycle stages.

What is purchase price allocation in valuations?

Purchase price allocation (PPA) distributes acquisition costs among acquired assets and liabilities based on fair values as required by ASC 805 accounting standards. This process identifies and values intangible assets including customer relationships, technology, trade names, and workforce-in-place. Professional valuation firms like Sofer Advisors specialize in PPA engagements ensuring compliance while maximizing tax benefits through proper asset classification.

Are business valuations tax deductible?

Business valuations are generally tax deductible as ordinary business expenses when obtained for legitimate business purposes including financial reporting, transaction support, or operational decision-making. Personal valuations for estate planning or divorce proceedings may not qualify for business deductions. Consult tax professionals regarding specific deductibility requirements and documentation necessary to support expense claims.

What makes a valuation defensible?

Defensible valuations employ recognized methodologies, reasonable assumptions, and comprehensive analysis supported by credible data sources and professional judgment. Proper documentation, industry research, and consideration of multiple approaches strengthen valuation conclusions while addressing potential weaknesses or limitations. Qualified appraisers with relevant experience and professional certifications provide additional credibility during challenges or disputes.

Key Takeaways

Professional business valuation services provide the objective analysis and regulatory compliance essential for successful transactions, tax planning, and strategic decision-making. Whether navigating mergers and acquisitions, estate planning, financing, immigration, litigation or financial reporting requirements, qualified valuation professionals deliver defendable assessments that withstand regulatory scrutiny while supporting critical business objectives. Sofer Advisors combines technical expertise with accessible communication, transforming complex Wall Street methodologies into Main Street understanding that empowers confident decision-making.

Ready to discuss your valuation needs?

Schedule Your Free Consultation With Sofer Advisors

This article provides general information for educational purposes only and does not constitute legal, tax, financial, or professional advice – consult qualified professionals regarding your specific circumstances.