What Documents Do I Need for a Business Valuation? Complete Checklist

Last Updated: Feb 2026

A business valuation requires three to five years of financial statements, tax returns, organizational documents, operational data, and industry-specific materials to support accurate value conclusions. Complete documentation enables valuators to analyze financial performance, assess risk factors, research market comparables, and defend methodology choices when regulatory agencies or opposing parties scrutinize results. Organized comprehensive information provision at engagement accelerates timelines by weeks while incomplete documentation creates delays, requires expensive follow-up requests, and may compromise analytical quality when critical data remains unavailable despite repeated requests.

Document preparation matters because missing information directly impacts valuation quality and defensibility. IRS agents challenge gift tax valuations lacking complete financial documentation. Courts exclude expert testimony when valuators cannot document assumption bases. Financial statement auditors reject purchase price allocations missing acquired asset details. Lenders question valuations supporting financing requests without comprehensive supporting materials. Transaction counterparties discount conclusions from reports acknowledging information limitations. Proactive document gathering prevents these risks while demonstrating management sophistication that enhances valuator confidence in provided information accuracy.

What financial and corporate documents does every valuation require?

Historical financial statements form the valuation foundation. Valuators need three to five years of year-end balance sheets, income statements, and cash flow statements. Companies with audited statements should provide audit reports including footnotes. Businesses with reviewed or compiled statements provide those reports plus trial balances.

Current year interim financials through the most recent month-end or quarter-end capture recent performance. Interim statements should include balance sheets and income statements at minimum.

Tax returns for corresponding periods validate reported financial performance. Provide complete returns including all schedules and K-1s. C corporations provide Form 1120. S corporations provide Form 1120S. Partnerships provide Form 1065.

Detailed trial balances or general ledgers for current and prior year support financial analysis. General ledgers allow valuators to examine transaction details and identify unusual items.

Sofer Advisors provides customized information request lists at engagement specifying exact requirements. Gathering core financials proactively before engagement eliminates common timeline delays.

Articles of incorporation or formation establish the legal entity. Provide original articles plus all amendments. These specify share classes, voting rights, and structural features affecting value.

Bylaws or operating agreements govern internal operations. Current amended versions work best. Valuators examine provisions addressing share transfer restrictions and buy-sell mechanisms.

Stock ledgers or capitalization tables document ownership. Complete ledgers show all share issuances, transfers, and repurchases from inception. Ownership documentation becomes critical for minority interest valuations.

Shareholder agreements and buy-sell agreements affect transferability. Provide all current agreements including amendments. Right of first refusal provisions and mandatory purchase provisions impact marketability.

Board minutes for the past two years provide context about major decisions. Valuators review minutes for acquisitions, financing activities, significant contracts, and litigation developments.

The following table outlines essential documentation:

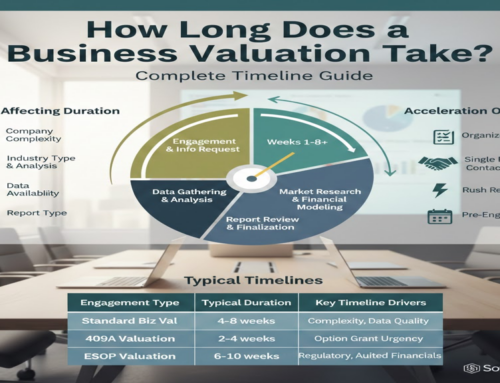

| Service Type | Typical Fee Range | Standard Timeline | Key Deliverable |

|---|---|---|---|

| Standard Business Valuation | $7,500 – $25,000 | 4-8 weeks | Detailed valuation report |

| 409A Valuation | $2,500 – $9,000 | 2-4 weeks | Summary report for stock option compliance |

| Purchase Price Allocation | $15,000 – $50,000 | 6-12 weeks | Asset allocation schedule per ASC 805 |

| Fairness Opinion | $15,000 – $40,000 | 4-8 weeks | Opinion letter for transaction fairness |

| ESOP Valuation | $15,000 – $35,000 | 6-10 weeks | Annual trustee report |

| Healthcare Practice | $10,000 – $30,000 | 4-8 weeks | Detailed report with Stark Law compliance |

| Update Valuation | 50-70% of original | 2-4 weeks | Refreshed report with current data |

What operational information supports valuations?

Customer concentration analysis reveals revenue dependency risks. Provide top 10-20 customers showing revenue by customer for the past three years. Long-term customer contracts demonstrate relationship stability.

Revenue breakdown by product line or service type for the past three years shows diversification. Geographic revenue distribution indicates market exposure.

Employee census including position, tenure, and compensation for key personnel documents human capital. Management depth affects sustainability risk.

Facility information including lease agreements or owned property details supports asset analysis. Lease agreements should include terms, renewal options, and escalation clauses.

Major contracts with customers, suppliers, or strategic partners affect enterprise value. Material customer contracts demonstrate revenue visibility. Supplier agreements with favorable terms represent competitive advantages.

Pending litigation, disputes, or regulatory matters require disclosure. Provide complaint filings and legal counsel opinions on probable outcomes.

How do industry requirements vary by business type?

Healthcare practices require specialized documentation. Provide payer contracts with reimbursement rates, physician employment agreements, and Stark Law compliance documentation. Patient demographics and referral source analysis show market positioning.

Technology companies need intellectual property documentation. Patent registrations, trademark filings, and software development cost policies affect financials. Customer contracts with recurring revenue support valuation multiples.

Restaurant valuations demand location analysis. Provide lease agreements, sales mix by daypart, table turn rates, and health department inspection reports. Franchise agreements require complete disclosure.

Construction companies present unique needs. Backlog schedules, work-in-progress schedules, and bonding capacity letters demonstrate capabilities.

Manufacturing businesses require production information. Provide capacity utilization rates, supplier contracts, and quality control metrics.

Sofer Advisors has completed over 1,000 valuations across diverse industries, bringing specialized knowledge to industry-specific documentation requirements.

What accelerates timelines and what gaps should I avoid?

Financial projections for the next three to five years provide management perspective. Board-approved budgets carry more weight. Industry research commissioned by the company offers valuable context.

Prior valuations provide historical reference points. Earlier business appraisals help valuators understand value trends.

Marketing materials and capability statements help valuators understand competitive positioning. Awards and certifications signal quality.

Pre-engagement organization actions:

Financial Preparation:

- Compile all financial statements in one folder

- Gather tax returns with all schedules

- Create one-page ownership summary

- Document related party transactions

- Identify unusual or non-recurring items

Digital Organization:

- Scan documents into searchable PDFs

- Name files clearly with descriptive names

- Organize in logical folder structures

- Provide Excel versions of models if available

Related party transactions represent the most frequent omission. Companies fail to disclose real estate leases, management fees, or equipment rentals from related entities. Undisclosed arrangements create delays and credibility concerns.

Interim financial statement unavailability delays engagements. Companies need current year performance through at least the most recent quarter.

Ownership structure complexity without documentation causes confusion. Stock option grants, warrants, or convertible securities require clear explanation.

Customer concentration without mitigation explanations concerns valuators. Companies deriving 30%+ revenue from single customers face significant risk requiring context.

How should I organize and deliver documents?

Electronic delivery through secure file sharing platforms works best. Services like ShareFile or Dropbox Business allow organized folder structures. Email attachments become unwieldy with dozens of documents.

Logical folder organization prevents valuator searching. Create main folders for Financial Statements, Tax Returns, Corporate Documents, and Operational Data. Subfolders by year improve navigation.

Complete documents without missing pages prevent follow-up requests. Tax returns need all schedules. Financial statements should include all footnotes.

Searchable PDFs rather than scanned images accelerate analysis. Excel files for financial models allow valuators to test assumptions.

Sofer Advisors provides secure file sharing portals at engagement ensuring organized confidential information exchange.

Frequently Asked Questions

What if my financial statements aren’t audited or reviewed?

Compiled financial statements or internally prepared statements work for many valuation purposes. However, IRS gift tax valuations, ESOP annual valuations, and litigation often require audited statements for credibility. If you lack formal statements, valuators can work from tax returns plus internally prepared balance sheets and income statements. Quality depends on your accounting systems and controls. Companies with sophisticated QuickBooks or other accounting software generally provide adequate information. Those operating primarily from bank statements or tax software require more extensive financial reconstruction adding time and cost to engagements.

Do I need to provide documents for related entities or only the valued company?

Provide documents for all related entities having transactions with the valued company. Real estate holding companies leasing property to the operating business require financial statements and lease agreements. Management companies providing services need documentation. Related party transactions must be identified and adjusted to market rates. Consolidated entities require separate entity statements plus consolidating workpapers. Some valuations include multiple entities-for example, valuing an operating company plus its real estate together. Discuss entity scope with your valuator at engagement to clarify which entities need documentation.

How far back should historical financial information go?

Three to five years of historical financials provides adequate trend analysis for most situations. Five years works better showing full economic cycles. However, companies in existence less than five years provide inception-to-date financials. Startup companies with limited operating history supplement financials with projections, market research, and comparable company data. Longer operating histories strengthen analysis but information beyond five years rarely adds value unless the business experienced fundamental changes requiring historical context. Acquisitions, restructurings, or strategy shifts may necessitate pre-change financial disclosure.

Can I provide tax returns instead of financial statements?

Tax returns alone work for simple service businesses with minimal balance sheet complexity. However, tax returns lack detail needed for comprehensive valuations. They provide annual snapshots without interim period updates. Cash basis tax returns don’t reflect accounts receivable or payable. Depreciation schedules don’t indicate fixed asset composition or useful lives. Related party transactions may not be apparent. Most professional valuations require GAAP or tax basis financial statements supplementing tax returns. If you lack formal statements, discuss with your accountant whether compiling statements before engagement makes sense or whether tax returns plus supplemental schedules suffice for your purpose.

What interim financial information is needed if my valuation date is mid-year?

Provide financial statements through the most recent month-end or quarter-end before the valuation date. For example, September 30 valuation dates need financials through at least June 30 and ideally through August 31. Valuators cannot value businesses without understanding current year performance. If your company doesn’t prepare formal interim statements, develop at least monthly sales summaries, gross profit calculations, and overhead expense tracking. More timely information improves accuracy-three-month-old financials during rapidly changing conditions create uncertainty. Many businesses prepare monthly internals for management purposes even without external reporting requirements.

How should I handle confidential or sensitive information?

All reputable valuators maintain strict confidentiality and many hold CPA licenses imposing professional confidentiality obligations. Sofer Advisors signs nondisclosure agreements when requested and maintains secure information handling protocols. However, you can redact truly confidential information not affecting valuation. Customer names can be anonymized showing “Customer A, Customer B” with revenue amounts. Specific contract pricing might be shown as percentages of market rates. Employee names can be masked showing only positions and compensation. However, redacting financial amounts, ownership details, or operational metrics prevents adequate analysis. Discuss confidentiality concerns at engagement to establish appropriate handling procedures.

What happens if I can’t locate certain requested documents?

Notify your valuator immediately when documents are unavailable. Many gaps have workarounds. Missing prior year tax returns may be obtainable from IRS transcript services. Lost corporate documents might be reconstructed from state records. Unavailable contracts can be summarized from memory with best recollection disclosures. Some missing items require specific solutions-lost stock ledgers may necessitate shareholder affidavits. Valuators document information limitations in reports. However, material gaps may prevent opinion issuance or require qualification language reducing report usefulness. Early disclosure allows exploring alternatives rather than discovering gaps late in the process.

Should I provide information my accountant holds or just what I have?

Provide everything accessible through reasonable effort including documents your accountant holds. Accountants typically maintain tax returns, financial statement workpapers, and depreciation schedules. Request these materials when engaging valuators. Some accountants charge for document production. Information gathering shouldn’t require months but one to two weeks makes sense. Companies switching accountants recently should contact former accountants for historical records.

Can I submit documents in batches or should everything come at once?

Submit comprehensive initial packages then supplement with additional items. Front-load critical documents-financial statements, tax returns, and organizational documents. Avoid piecemeal submission of dozens of one-off documents over weeks. Batch related items-all contracts together. Include document indices with each submission. Business valuation timelines depend heavily on information flow. Complete upfront provision beats slow trickle dramatically.

What documentation differences exist between gift tax and litigation valuations?

Gift tax valuations for the IRS require extremely thorough documentation defending minority discounts and marketability discounts. Provide all shareholder agreements, transfer restrictions, and buy-sell provisions. Document company financial condition comprehensively since IRS agents scrutinize closely. Include any appraisals of underlying assets-real estate, equipment, intangibles. Prior gifts or sales of interests require disclosure. Litigation valuations face opposing expert scrutiny. Anticipate information requests from opposing counsel during discovery. Missing documents create impeachment opportunities. Litigation valuators often issue preliminary requests followed by supplemental requests as opposing experts identify gaps. Both contexts demand more documentation than transaction or internal planning valuations where interested parties already access information.

Conclusion

Comprehensive document preparation directly impacts valuation quality, defensibility, and timeline efficiency. Core requirements include three to five years of financial statements, tax returns, organizational documents, operational data, and industry-specific materials. Organized proactive provision accelerates timelines by weeks while preventing analytical gaps that compromise conclusion reliability.

Sofer Advisors provides comprehensive business valuation services with detailed customized information request lists ensuring you provide exactly what’s needed without wasting time gathering immaterial items. Our systematic approach backed by 180+ five-star Google reviews and Inc. 5000 recognition delivers quality conclusions supported by thorough documentation analysis.

Schedule a consultation to discuss your business valuation documentation needs and receive our comprehensive information request checklist tailored to your specific situation.

This article provides general information for educational purposes only and does not constitute legal, tax, financial, or professional advice-consult qualified professionals regarding your specific circumstances.