Medical Practice Valuation Atlanta: Healthcare Sale & Transition Guide

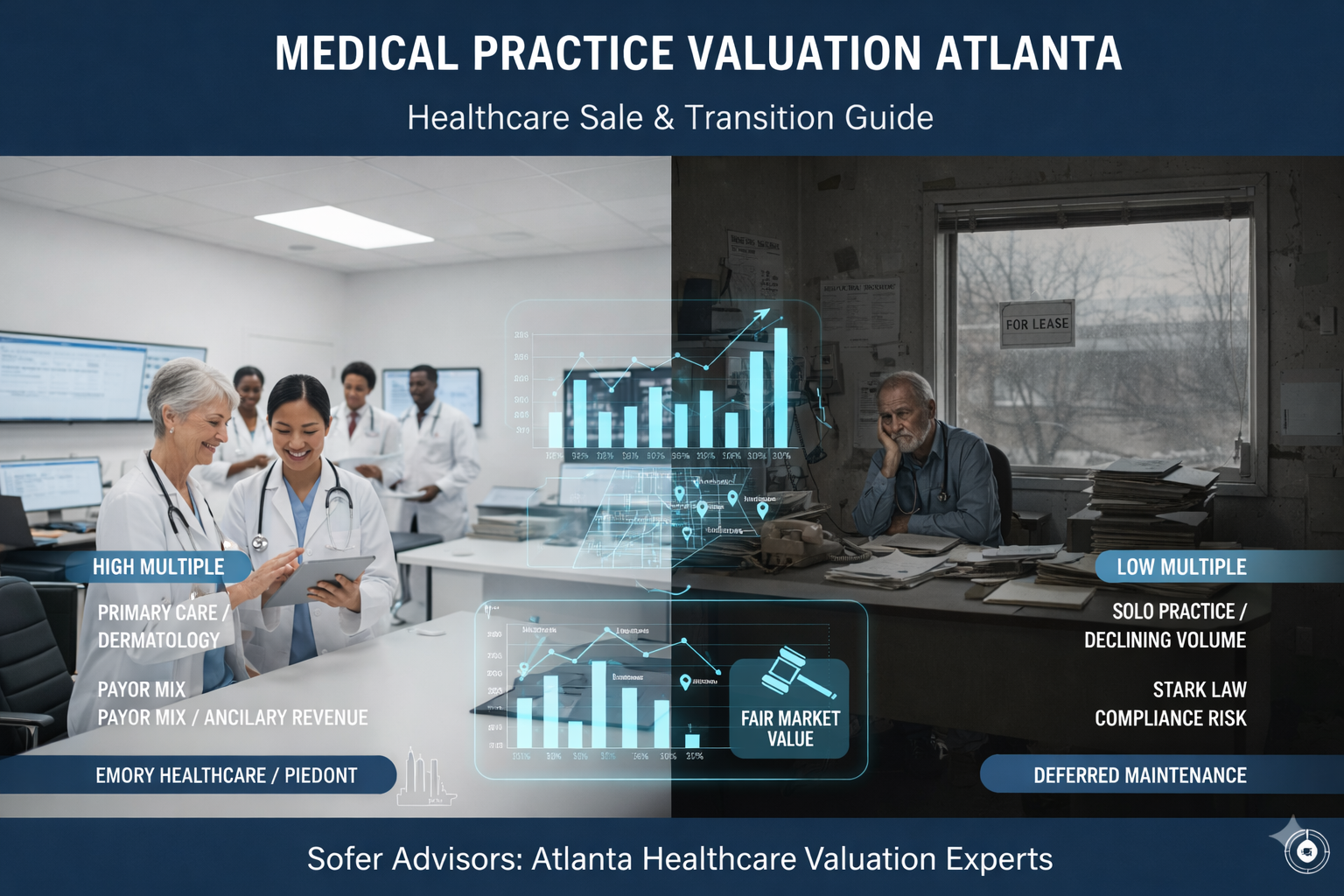

A medical practice valuation in Atlanta refers to the professional appraisal process that determines fair market value for physician practices, clinics, and healthcare businesses while ensuring compliance with federal regulations governing healthcare transactions. These valuations matter because Atlanta’s healthcare market-home to major systems like Emory Healthcare, Piedmont, and Northside Hospital-creates both acquisition opportunities and regulatory complexity that general business valuations cannot address. For Georgia physicians considering retirement, partnership changes, or health system employment, understanding healthcare-specific valuation requirements protects both transaction value and regulatory compliance.

Healthcare valuations differ fundamentally from standard business appraisals due to Stark Law, Anti-Kickback Statute, and state regulations governing physician compensation and practice acquisitions. These regulations require that transaction values reflect fair market value without consideration of referral relationships-a standard that demands specialized expertise. Atlanta’s competitive healthcare landscape, with independent practices facing consolidation pressure from hospital systems and private equity, makes accurate valuation essential for physicians navigating sale, merger, or employment transitions.

How Much Is a Medical Practice Worth in Atlanta?

Medical practice values in Atlanta typically range from 40% to 80% of annual collections, though this simplified metric obscures significant variation based on specialty, payor mix, provider dependency, and regulatory considerations. More sophisticated valuations apply income and market approaches specific to healthcare transactions.

Sofer Advisors, an Atlanta-based valuation firm with 180+ five-star Google reviews and expertise in healthcare transactions, applies fair market value standards required for Stark Law and Anti-Kickback Statute compliance. Our healthcare practice valuations typically range from $10,000 to $30,000 depending on practice complexity and transaction requirements.

| Medical Specialty | Typical Multiple | Key Value Drivers |

|---|---|---|

| Primary Care / Family Medicine | 40% – 60% collections | Patient panel size, payor mix, location |

| Cardiology | 50% – 75% collections | Ancillary revenue, Cath lab access, call coverage |

| Orthopedics | 50% – 70% collections | Surgery volume, ASC ownership, imaging |

| Dermatology | 60% – 80% collections | Cosmetic revenue, Mohs capability, mid-levels |

| Gastroenterology | 55% – 75% collections | ASC ownership, screening volume, facility fees |

| Ophthalmology | 50% – 70% collections | Optical revenue, surgery volume, LASIK |

| Psychiatry / Behavioral Health | 45% – 65% collections | Reimbursement trends, telehealth capability |

These ranges represent starting points, not definitive values. Actual practice worth depends on normalized earnings, growth trajectory, provider retention expectations, and transaction structure. A cardiology practice generating $3 million in collections might value between $1.5 million and $2.25 million before considering ancillary services, real estate, or accounts receivable treatment.

How Does Stark Law Affect Medical Practice Valuations?

Stark Law (the Physician Self-Referral Law) fundamentally shapes healthcare valuations by requiring that compensation arrangements between physicians and entities to which they refer reflect fair market value and not take into account the volume or value of referrals. Violations carry severe penalties including refund of all Medicare payments, civil monetary penalties, and False Claims Act liability.

For Atlanta medical practice transactions, Stark Law compliance requires that purchase prices, employment compensation, and ongoing arrangements pass fair market value scrutiny. This means valuations must be performed by qualified professionals using recognized methodologies, without consideration of referral value. A practice that refers significant volume to the acquiring hospital system cannot command premium pricing based on that referral stream.

Key Stark Law valuation requirements for Georgia healthcare transactions:

- Purchase price must reflect fair market value of tangible and intangible assets

- Compensation arrangements cannot vary with referral volume

- Personal goodwill may be compensable but requires careful documentation

- Non-compete agreements must be reasonable in scope and geography

- Technical component values cannot include referral premiums

- Valuations should be performed by qualified independent appraisers

David Hern CPA ABV ASA, founder of Sofer Advisors, notes that Stark Law compliance increasingly drives transaction structure in Atlanta’s healthcare market. Hospital systems and private equity buyers require independent fair market value opinions before closing acquisitions. Physicians who obtain pre-transaction valuations position themselves advantageously in negotiations while demonstrating compliance commitment. Review our complete healthcare valuation guide for detailed regulatory analysis.

What Role Does Personal Goodwill Play in Practice Sales?

Personal goodwill-value attributable to individual physicians’ reputations, skills, and patient relationships-significantly impacts medical practice valuations and transaction structuring. Unlike enterprise goodwill (transferable practice value), personal goodwill typically remains with the physician and may be compensable separately.

For tax purposes, personal goodwill allocation can provide significant benefits. Personal goodwill sales may qualify for capital gains treatment rather than ordinary income, and buyers can amortize purchased goodwill. However, aggressive allocations invite IRS scrutiny, making proper documentation essential.

| Goodwill Type | Personal Goodwill | Enterprise Goodwill |

|---|---|---|

| Source | Physician’s reputation, skills, relationships | Practice systems, brand, location, staff |

| Transferability | Cannot transfer without physician | Transfers with practice sale |

| Tax Treatment | Capital gains to selling physician | Ordinary income or entity-level gain |

| Stark Implications | May be compensable if properly documented | Must reflect fair market value |

| Non-Compete Impact | Typically requires reasonable restriction | Supports value without restriction |

In Atlanta’s healthcare market, personal goodwill often represents 30% to 60% of total practice value for solo practitioners and key physicians in group settings. Specialists with unique skills, established referral relationships, and strong patient loyalty command higher personal goodwill allocations. Proper documentation-including employment history, patient relationship analysis, and referral pattern studies-supports allocations during IRS examination or buyer due diligence.

How Do Hospital Acquisitions Value Independent Practices?

Hospital systems acquiring independent practices in Atlanta apply specific valuation frameworks driven by regulatory requirements, strategic objectives, and integration costs. Understanding buyer perspectives helps physicians negotiate effectively and structure transactions advantageously.

Hospital acquirers typically value practices through a combination of income approach (capitalized earnings or discounted cash flow), market approach (comparable transaction analysis), and strategic value assessment (network development, service line expansion, or competitive positioning). However, Stark Law constraints mean that strategic value-including referral potential-cannot inflate purchase prices.

Major Atlanta health systems including Emory Healthcare, Piedmont Healthcare, Northside Hospital, and Wellstar approach acquisitions differently based on strategic priorities. Some emphasize employed physician models while others prefer professional services agreements. Understanding buyer motivations-whether geographic coverage, specialty depth, or ancillary service access-helps physicians position practices effectively. Review how to value your business for sale for transaction preparation strategies.

Hospital acquisition valuations typically include tangible assets (equipment, furniture, supplies), intangible assets (patient records, trained staff, assembled workforce), enterprise goodwill (practice systems, reputation, location advantages), and potentially personal goodwill (physician-specific value requiring continued service). Accounts receivable and real estate usually receive separate treatment. Physicians should expect due diligence examining payor contracts, billing practices, compliance history, and malpractice claims.

What Factors Destroy Medical Practice Value?

Understanding common value destroyers helps Atlanta physicians protect practice worth and address issues before marketing. Healthcare transactions face unique risks beyond standard business sale concerns due to regulatory complexity and provider dependency.

Critical factors that kill medical practice value during due diligence:

- Compliance red flags: Billing irregularities, coding errors, or incomplete documentation

- Provider dependency: Key physician planning retirement without transition support

- Unfavorable payor mix: Heavy Medicaid or uncompensated care exposure

- Declining volume: Negative patient or procedure trends without explanation

- Staff issues: Key employee departures, union concerns, or training gaps

- Lease problems: Expiring terms, above-market rent, or landlord issues

- Technology gaps: Outdated EHR, interoperability limitations, or cybersecurity concerns

- Malpractice history: Open claims, adverse judgments, or elevated premiums

Addressing these issues before engaging buyers maximizes value and reduces transaction risk. Compliance audits, billing reviews, and operational assessments identify correctable problems. Sofer Advisors, with 15+ years of valuation experience, helps physicians understand value drivers and enhancement opportunities during the valuation process.

How Long Does Medical Practice Sale Take in Atlanta?

Medical practice sales in Atlanta typically require 9-18 months from initial planning through closing, though timeline varies based on buyer type, transaction complexity, and regulatory requirements. Understanding realistic timelines helps physicians plan transitions and maintain practice operations during extended sale processes.

The valuation phase typically requires 4-8 weeks for comprehensive healthcare practice appraisals. Marketing and buyer identification may extend 3-6 months depending on specialty desirability and market conditions. Due diligence-particularly regulatory compliance review-adds 60-120 days. Definitive agreement negotiation and closing typically require 60-90 additional days. Physicians planning exit strategies should begin 2-3 years before target transition dates.

Hospital system acquisitions often move faster than physician-to-physician sales due to dedicated development teams and established processes. Private equity transactions may proceed quickly when platform investments seek add-ons in specific specialties. Solo practitioner sales to individual buyers typically take longest due to financing complexity and operational transition requirements.

Maintaining practice performance during extended sale processes proves critical. Declining volumes or departing staff during negotiations reduce value and may derail transactions. Engage experienced healthcare transaction advisors who understand physician practice dynamics and can maintain confidentiality while marketing effectively.

Frequently Asked Questions

How much is my medical practice worth in Atlanta?

Atlanta medical practice values typically range from 40% to 80% of annual collections depending on specialty, payor mix, provider dependency, and ancillary services. A practice collecting $2 million annually might value between $800,000 and $1.6 million before adjustments. Professional valuation provides accurate conclusions reflecting your specific circumstances and regulatory requirements.

What multiple do medical practices sell for in Georgia?

Georgia medical practices typically sell for 0.4x to 0.8x annual collections or 2x to 4x normalized EBITDA depending on specialty. Primary care commands lower multiples (40-60% collections) while high-demand specialties like dermatology reach 60-80%. Transaction structure, regulatory compliance, and provider transition terms significantly affect realized multiples.

How does Stark Law affect medical practice valuations?

Stark Law requires that physician practice transaction values reflect fair market value without consideration of referral volume or value. This means valuations must be performed by qualified independent appraisers using recognized methodologies. Purchase prices cannot include premiums for expected referrals, and compensation arrangements must pass regulatory scrutiny.

What’s the difference between clinical and enterprise value?

Clinical value reflects earnings from professional services-physician time generating revenue. Enterprise value includes broader practice assets: systems, staff, location, equipment, and transferable patient relationships. Healthcare valuations often separate these components because clinical value depends on specific providers while enterprise value transfers with ownership.

How do I value a medical practice with multiple physicians?

Multi-physician practices require analysis of individual provider contributions, partnership agreements, and departure scenarios. Key considerations include revenue attribution, compensation structures, buy-sell provisions, and personal versus enterprise goodwill allocation. Practices with diversified revenue across multiple providers typically command premium valuations due to reduced dependency risk.

Does my specialty affect practice valuation?

Specialty significantly impacts practice valuation through reimbursement levels, demand trends, ancillary opportunities, and market competition. Procedural specialties with ancillary services often command higher multiples than cognitive-based practices. Market dynamics in Atlanta-including hospital competition for specific specialties-also affect realized values.

How do payer contracts impact medical practice value?

Payor contracts significantly affect practice value through reimbursement rates, patient volume, and administrative burden. Practices with favorable commercial insurance rates, limited Medicaid exposure, and established Medicare participation command premiums. Contract transferability to buyers requires careful analysis-some agreements terminate upon ownership change.

What role does personal goodwill play in physician practice sales?

Personal goodwill-value tied to individual physicians’ reputations and patient relationships-often represents 30-60% of practice value for solo practitioners. Personal goodwill may receive favorable capital gains treatment and requires careful documentation for tax and regulatory compliance. Proper allocation analysis supports values during IRS examination.

How long does it take to sell a medical practice in Atlanta?

Atlanta medical practice sales typically require 9-18 months from planning through closing. Valuation takes 4-8 weeks, marketing 3-6 months, due diligence 60-120 days, and closing 60-90 days. Hospital acquisitions may proceed faster; solo practitioner sales often take longer. Begin planning 2-3 years before target transition.

Should I get a valuation before talking to buyers?

Pre-transaction valuation provides significant advantages: understanding realistic value expectations, identifying enhancement opportunities, documenting fair market value for regulatory compliance, and negotiating from informed positions. Physicians who engage buyers without independent valuation often leave value on the table or face regulatory challenges.

How do hospital acquisitions value independent practices?

Hospital systems apply income, market, and strategic approaches while maintaining Stark Law compliance. Valuations include tangible assets, intangibles (patient records, staff, systems), and potentially personal goodwill. Strategic value from referrals cannot inflate prices. Due diligence examines compliance, payor contracts, and malpractice history extensively.

What kills medical practice value during due diligence?

Common value destroyers include compliance red flags (billing irregularities, coding errors), provider dependency without transition plans, unfavorable payor mix, declining volumes, staff issues, lease problems, technology gaps, and malpractice concerns. Addressing these issues before marketing maximizes value and reduces transaction risk.

Conclusion

Medical practice valuation in Atlanta requires specialized expertise addressing healthcare regulatory requirements, specialty-specific value drivers, and complex transaction structures. Stark Law and Anti-Kickback Statute compliance demands qualified independent appraisers who understand fair market value standards governing physician compensation and practice acquisitions.

Whether selling to hospital systems, private equity, or individual physicians, Atlanta healthcare providers benefit from pre-transaction valuation establishing realistic expectations, identifying value enhancement opportunities, and documenting regulatory compliance. Personal goodwill analysis and proper allocation can provide significant tax benefits while supporting defensible transaction structures.

Sofer Advisors provides comprehensive medical practice valuation services throughout Georgia, backed by 180+ five-star Google reviews and healthcare transaction expertise. Our dual-credentialed team delivers fair market value opinions meeting Stark Law and Anti-Kickback Statute requirements.

SCHEDULE A CONSULTATION: Contact us to discuss your Atlanta medical practice valuation needs and navigate your healthcare transition successfully.

People Also Read

- Healthcare Business Valuation Methods Guide

- How to Calculate Fair Market Value of a Company

- When to Start Succession Planning: Strategic Timeline Guide

This article provides general information for educational purposes only and does not constitute legal, tax, financial, or professional advice-consult qualified professionals regarding your specific circumstances. Healthcare transactions involve complex regulatory requirements; always consult healthcare attorneys and compliance specialists.