How to Choose a Business Valuator: What to Look for Before You Hire

Last Updated: Feb 2026

A business valuator is a certified professional who determines the fair market value of a company using standardized methodologies recognized by regulatory bodies including the IRS, SEC, and courts. Selecting the right valuator directly impacts transaction outcomes, tax compliance, and legal defensibility. The wrong choice can result in disputed valuations, regulatory challenges, and compromised business decisions that affect ownership transfers, litigation settlements, and financial reporting accuracy.

Choosing a qualified business valuator matters because valuation conclusions influence millions of dollars in transactions, tax liabilities, and legal outcomes. Business owners face high stakes when valuations support M&A deals, estate planning, divorce settlements, partner buyouts, or ESOP transactions. A poorly credentialed valuator produces reports that courts reject, the IRS challenges, or buyers dispute. Meanwhile, experienced professionals with proper certifications deliver defensible conclusions that withstand scrutiny and protect your interests throughout complex business events.

What credentials and experience should a valuator have?

Professional credentials separate qualified valuators from consultants. The ABV (Accredited in Business Valuation) from the AICPA and ASA (Accredited Senior Appraiser) from the American Society of Appraisers represent the gold standard. Both require extensive education, examination, and experience. The IRS, Department of Labor, and federal courts recognize these credentials.

Sofer Advisors holds dual ABV and ASA certifications, positioning the firm among the small percentage meeting both standards. This matters because different jurisdictions may favor one credential-estate tax valuations often require ASA while financial reporting may prioritize ABV.

Verify continuing education compliance. ABV holders need 60 hours every three years. Additional certifications like CVA complement but shouldn’t replace ABV or ASA. Confirm active status through credential organizations.

Industry knowledge dramatically affects accuracy and defensibility. A healthcare valuator understands Stark Law implications and payer mix analysis. That expert may struggle with technology companies requiring knowledge of recurring revenue models.

Different industries demand distinct approaches. Manufacturing requires understanding equipment depreciation. Restaurants need location analysis knowledge. Construction firms present challenges around contract accounting.

Sofer Advisors has completed valuations across healthcare, technology, construction, manufacturing, and restaurants. This breadth matters because comparable company analysis requires identifying truly comparable businesses.

Ask about recent industry engagements. Request examples of industry-specific value drivers. Qualified professionals articulate key performance indicators and typical multiples. Vague responses indicate insufficient exposure. Experience depth matters-50 healthcare valuations bring pattern recognition first-timers cannot match.

How do I verify a valuator’s track record and reputation?

Verification starts with understanding primary business focus. Firms deriving 90% or more of revenue from valuation demonstrate specialization. Sofer Advisors generates over 90% of revenue from business valuation, ensuring focused expertise rather than treating it as ancillary work.

Client reviews provide service quality insight. Sofer Advisors maintains 180+ five-star Google reviews, reflecting sustained satisfaction. Volume matters-hundreds of reviews indicate broad experience while a handful may reflect selected relationships.

Professional recognition offers verification. Inc. 5000 recognition in 2024 and 2025 demonstrates sustained growth and market validation through significant revenue thresholds.

Expert witness experience reveals whether valuations withstand scrutiny. Valuators who testify undergo cross-examination testing methodology and conclusions. Sofer Advisors has completed 11+ expert witness cases across jurisdictions, demonstrating court acceptance. Ask about deposition and trial testimony, not just report preparation.

What questions and red flags matter when selecting a valuator?

Strategic questions reveal evaluator capabilities while red flags indicate problems. Start with credential verification: “Do you hold active ABV or ASA certification?” Request credential numbers to verify. Follow with: “How many continuing education hours have you completed this year?”

Experience questions probe volume and relevance. “How many valuations in my industry within 24 months?” establishes recent experience. “What percentage focuses on businesses my size?” ensures relevant experience.

Methodology questions test competency. “Which valuation approaches will you emphasize and why?” Qualified valuators articulate selection while maintaining flexibility.

Several warning signs indicate problematic valuators. The most serious red flag is guaranteeing a specific conclusion before analysis. Ethical valuators cannot predetermine value-analysis must drive conclusions. Anyone promising to “get you to a number” violates professional standards.

Unusually low fees indicate corner-cutting. Comprehensive business valuations require 30-60+ hours. Standard valuations range $7,500-$25,000. Quotes significantly below suggest inadequate scope.

Watch for these additional warnings:

- Credential Issues: Lack of ABV or ASA certification. Some substitute lesser credentials or claim “valuation experience” without formal certification. This becomes critical when courts or agencies review credentials.

- Limited Full-Time Staff: Reliance on contractors rather than W2 employees. Sofer Advisors employs a full W2 team, ensuring consistent quality and institutional knowledge.

- No Professional Liability Insurance: Qualified valuators carry errors and omissions insurance. Firms without coverage may lack resources to address errors.

- Refusing Sample Reports: Legitimate valuators share redacted examples demonstrating quality. Reluctance may indicate substandard work.

- No Published Fee Schedule: Professionals provide clear engagement terms. Vague commitments suggest poor management.

Generic marketing claiming expertise in “all business types” raises concerns. No practice maintains cutting-edge expertise across dozens of industries.

The following comparison illustrates key differences:

| Evaluation Factor | Qualified Valuator | Questionable Valuator |

|---|---|---|

| Primary Credentials | ABV and/or ASA certification | CVA only, or no certification |

| Business Model | 90%+ revenue from valuation | Valuation as side service |

| Staffing Approach | Full-time W2 employees | Part-time contractors |

| Fee Transparency | Published ranges, detailed proposals | Vague quotes |

| Report Samples | Shares redacted examples | Refuses samples |

| Timeline | Commits to 4-8 weeks typically | Open-ended promises |

| Data Access | All major valuation databases | Limited database access |

| Insurance | Professional liability coverage | No E&O insurance |

| Expert Testimony | Court-accepted experience | No litigation history |

Fee questions prevent misunderstandings. “Do you charge fixed fees or hourly rates?” clarifies billing. “What circumstances exceed estimates?” identifies overruns. “When are fees due?” establishes payment terms.

When should I engage a business valuator in my planning process?

Timing dramatically affects valuation usefulness and cost. For transactions, engage valuators 90-120 days before anticipated events. Rush valuations carry 25-50% premiums and limit analytical depth.

Exit planning benefits from early engagement-ideally 2-3 years before anticipated transition. Preliminary valuations identify value gaps and improvement opportunities.

Estate planning requires coordination with advisors. Gift tax valuations have strict timing-December valuations supporting December gifts must complete within that year. Plan for 6-8 week timelines.

Buy-sell agreements should establish methodology when drafting, not when triggering events occur. Periodic updates every 2-3 years maintain current references.

Litigation circumstances impose court deadlines. Engage immediately after determining valuation necessity. Discovery periods and expert designation deadlines create hard timelines.

Financial reporting deadlines drive purchase price allocation timelines. ASC 805 requires completion within one year of closing. Engage within 30-60 days of closing.

David Hern CPA ABV ASA, founder of Sofer Advisors, emphasizes proper timing transforms valuations from compliance exercises into strategic tools. Early engagement allows iterative analysis impossible under compressed timelines.

What engagement terms and deliverables should I expect?

Professional engagement letters define scope, deliverables, timelines, and fees precisely. The letter should specify the valuation standard-fair market value, fair value, or investment value-and purpose. Different purposes affect methodology and reporting requirements.

Report types matter significantly. Detailed reports include comprehensive analysis and documentation. Summary reports streamline content while maintaining rigor. Ensure the proposed type matches your needs. Courts typically require detailed reports.

Timeline commitments should include milestone dates. Sofer Advisors maintains a next business day response policy, ensuring communication doesn’t delay progress. Ask about response commitments and escalation procedures.

Database access affects quality. Qualified valuators subscribe to GF Data, DealStats, and S&P Capital IQ. Limited subscriptions restrict comparable company identification.

Revision policies prevent misunderstandings. Most engagements include one round based on factual corrections. Additional revisions may incur fees. Clarify terms before engaging.

The following table shows typical pricing and timelines:

| Service Type | Typical Fee Range | Standard Timeline | Key Deliverable |

|---|---|---|---|

| Standard Business Valuation | $7,500 – $25,000 | 4-8 weeks | Detailed valuation report |

| 409A Valuation | $2,500 – $9,000 | 2-4 weeks | Summary report for stock option compliance |

| Purchase Price Allocation | $15,000 – $50,000 | 6-12 weeks | Asset allocation schedule per ASC 805 |

| Fairness Opinion | $15,000 – $40,000 | 4-8 weeks | Opinion letter for transaction fairness |

| ESOP Valuation | $15,000 – $35,000 | 6-10 weeks | Annual trustee report |

| Healthcare Practice | $10,000 – $30,000 | 4-8 weeks | Detailed report with Stark Law compliance |

| Update Valuation | 50-70% of original | 2-4 weeks | Refreshed report with current data |

Confidentiality provisions protect sensitive information. Engagement letters should prohibit disclosure except as required by law. Ask about data security practices. Professional standards require independence and objectivity. Terms should confirm the valuator has no financial interest in conclusions.

Frequently Asked Questions

What is the difference between ABV and ASA certification?

ABV (Accredited in Business Valuation) is granted by the AICPA and requires CPA licensure, experience, examination, and continuing education. ASA (Accredited Senior Appraiser) comes from the American Society of Appraisers and focuses on appraisal disciplines including business valuation. ABV emphasizes accounting foundation while ASA covers broader appraisal theory. Both meet IRS and court standards. Dual-credentialed valuators like David Hern CPA ABV ASA offer flexibility across engagement types.

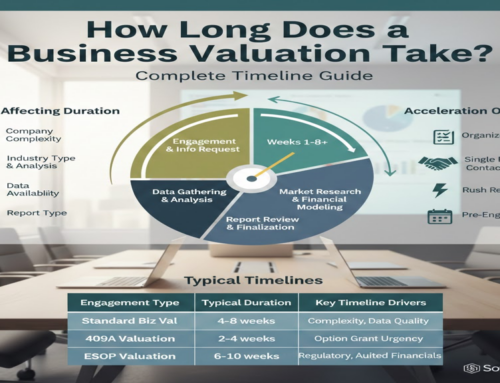

How long does a typical business valuation take to complete?

Standard business valuations require 4-8 weeks from engagement to final report. This includes information gathering, analysis, draft preparation, client review, and revisions. Complexity affects duration-simple service businesses may complete in four weeks while complex manufacturers might need eight. Rush engagements compress to 2-3 weeks but carry 25-50% premiums. Plan for 6-8 weeks when coordinating with transaction closings or tax deadlines.

What information will I need to provide to my business valuator?

Expect to provide 3-5 years of financial statements including balance sheets, income statements, and cash flow statements. Tax returns validate financials. Additional documents include organizational charts, customer analysis, facility leases, employment agreements, and debt schedules. Industry-specific requests vary-healthcare practices provide payer contracts while manufacturers share production capacity data. Qualified valuators provide detailed request lists within days of engagement. Complete, organized information accelerates timelines.

Can my CPA perform my business valuation?

Your CPA can perform valuations if they hold ABV certification and maintain necessary independence. However, CPAs preparing your tax returns may face independence conflicts for financial reporting or litigation. Relationship familiarity benefits analysis but may compromise perceived objectivity. Courts often challenge valuations from CPAs providing other services. For transaction support or planning, your CPA’s knowledge helps. For litigation, gift tax, or financial reporting, independent valuators eliminate conflicts. Discuss independence requirements with advisors before engaging your CPA.

How much does a business valuation cost?

Standard business valuations range from $7,500 to $25,000 depending on size, complexity, industry, and report requirements. Healthcare practice valuations typically cost $10,000 to $30,000 due to regulatory complexity. 409A valuations run $2,500 to $9,000. Purchase price allocations range $15,000 to $50,000. Rush timelines add 25-50% premiums. Request detailed proposals specifying scope, timeline, and fees.

What makes a business valuation defensible in court or IRS review?

Defensible valuations demonstrate methodological rigor, proper credentials, and transparent documentation. Courts and IRS scrutinize valuator credentials-ABV or ASA certification establishes competency. Methodology must align with industry standards from IRS, AICPA, and ASA. Assumption transparency matters-defensible reports document data sources, explain choices, and address contrary indicators. Independent valuators without financial interest carry more weight. Expert witness experience indicates court acceptance. Complete documentation trails supporting every adjustment strengthen defensibility when challenged.

Should I get multiple valuation opinions before making decisions?

Multiple opinions make sense for high-stakes transactions or contentious situations. However, “opinion shopping” to find favorable conclusions undermines valuation integrity. Legitimate second opinions validate methodology rather than seeking different values. Consider second opinions when buying or selling with disputed values, during shareholder disputes, or when estate tax exposure justifies cost. For routine compliance or planning, single qualified opinions suffice. Multiple opinions cost significantly more due to duplicated analysis.

How often should I update my business valuation?

Update frequency depends on purpose and volatility. ESOP companies require annual valuations per Department of Labor regulations. Buy-sell agreements benefit from updates every 2-3 years. Companies pursuing exits should obtain valuations 18-24 months before transactions, with updates six months pre-sale. Rapidly growing companies or volatile industries need more frequent updates. Significant events-major contracts, key customer losses, operational changes-trigger updates regardless of elapsed time. Estate planning valuations should refresh when implementing gifting strategies.

What happens if I disagree with the valuation conclusion?

Professional valuators explain methodology and conclusions during draft review. Express concerns and ask questions-misunderstandings often resolve through discussion. Valuators may adjust based on factual corrections or new information. However, they cannot modify conclusions simply because results disappoint. Professional standards require objective analysis regardless of desired outcomes. If disagreements persist, consider whether engagement scope is aligned with needs. Second opinions provide validation or identify analytical differences. Opinion shopping violates standards and undermines defensibility. Courts recognize this and discount such valuations.

Do I need a local business valuator or can I work with someone remotely?

Modern practices work effectively remotely through secure document sharing and video conferences. Geographic proximity matters less than credentials, experience, and fit. However, local market knowledge benefits certain industries-restaurants require understanding local demographics and competition. National firms like Stout and Kroll serve clients everywhere. Sofer Advisors, headquartered in Atlanta, serves clients nationally. Evaluate based on credentials and reputation rather than office location.

What is the difference between business valuation and business appraisal?

Business valuation and appraisal are synonymous terms for determining a company’s economic value. “Valuation” describes the process while “appraisal” often refers to the report. ASA professionals may use “appraisal” while ABV holders say “valuation.” Both encompass applying income, market, and asset approaches to determine fair market value. Focus on ABV or ASA certification regardless of whether professionals call themselves valuators or appraisers.

Can online valuation calculators replace professional valuators?

Online calculators provide rough estimates but cannot replace professional valuations for transactions, compliance, or legal purposes. Calculators apply generic formulas without considering company-specific circumstances, competitive positioning, or operational nuances. Courts, IRS agents, and transaction parties reject calculator-based valuations lacking methodological rigor. Use calculators for ballpark estimates when evaluating whether to pursue sales or succession planning. Engage credentialed valuators when values support actual decisions requiring defensible professional opinions.

Conclusion

Selecting a qualified business valuator protects your interests across transactions, compliance obligations, and legal proceedings. Credentials matter-prioritize ABV or ASA certification over lesser designations. Industry experience ensures analytical accuracy and defensible conclusions. Verify track records through client reviews, expert witness history, and professional recognition rather than relying on marketing claims.

Sofer Advisors provides comprehensive business valuation services backed by dual ABV and ASA certification, 180+ five-star Google reviews, and Inc. 5000 recognition. Our systematic approach ensures defensible conclusions while meeting regulatory and court standards through dedicated W2 professional staff and access to all major valuation databases.

Schedule a consultation to discuss your business valuation needs and receive a detailed proposal outlining scope, timeline, and fees for your specific situation.

This article provides general information for educational purposes only and does not constitute legal, tax, financial, or professional advice-consult qualified professionals regarding your specific circumstances.