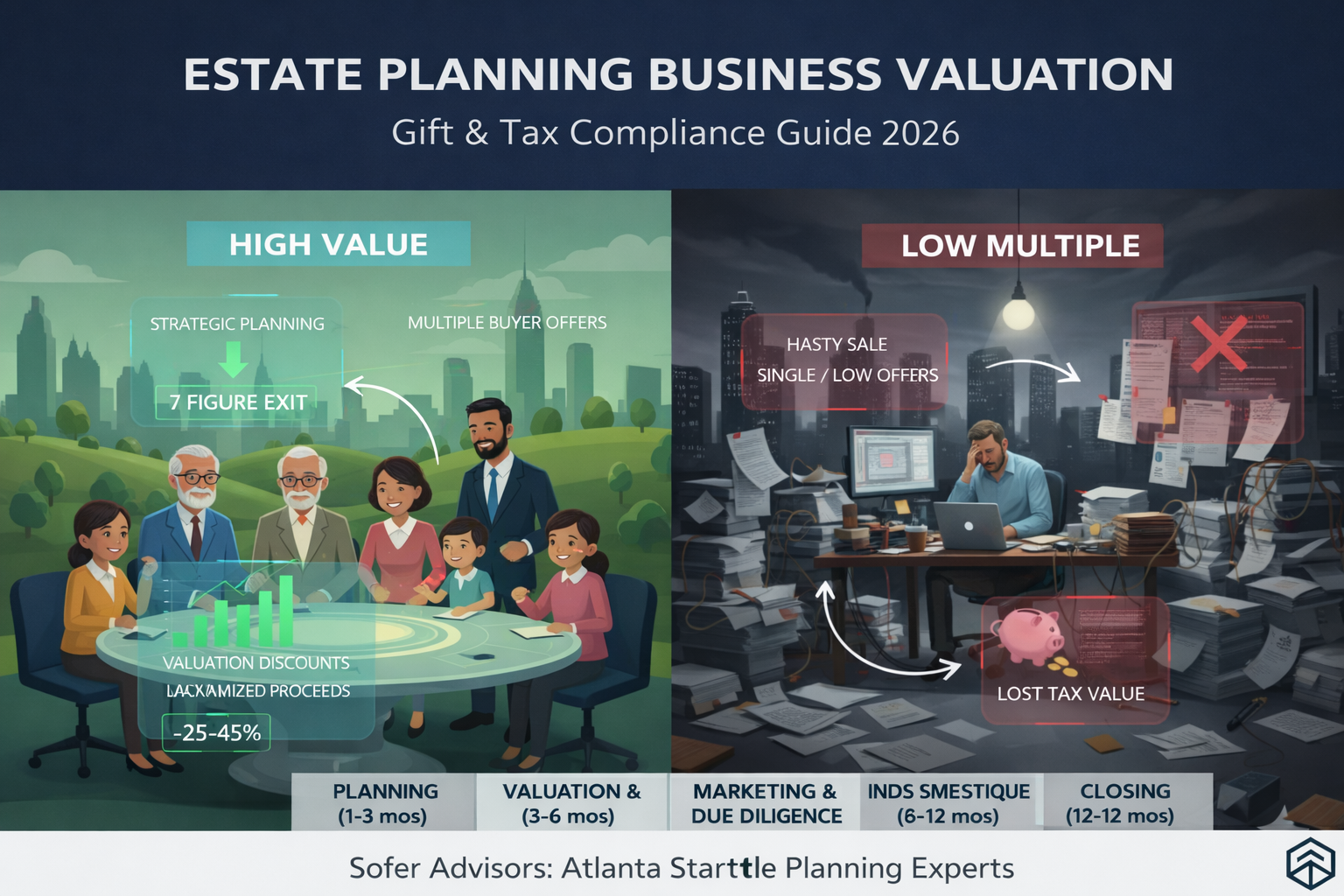

Estate Planning Business Valuation Georgia: Gift & Tax Compliance Guide

An estate planning business valuation in Georgia refers to a professional appraisal determining fair market value of closely-held business interests for gift tax, estate tax, and wealth transfer purposes, applying IRS-accepted methodologies and appropriate valuation discounts. This valuation matters because business interests often represent the largest asset in family estates, and proper valuation directly affects transfer tax liability-the difference between aggressive and conservative positions can exceed hundreds of thousands in taxes. For Georgia business owners planning wealth transfers to family members, understanding IRS requirements and available discounts enables tax-efficient succession while maintaining compliance.

The federal estate and gift tax exemption currently exceeds $13 million per individual (2024), but this historically high exemption is scheduled to decrease significantly after 2025 without Congressional action. Georgia business owners with substantial business value face a narrowing window for tax-efficient transfers. Additionally, Georgia does not impose a separate state estate tax, making federal planning the primary concern. Proper valuation-including defensible discount analysis-maximizes wealth transfer efficiency while creating documentation that withstands IRS scrutiny.

Why Do I Need a Business Valuation for Estate Planning?

Business valuations serve multiple estate planning purposes beyond simple tax compliance. Understanding these applications helps Georgia business owners recognize when professional appraisal adds value to their planning strategies.

Sofer Advisors, an Atlanta-based valuation firm with 180+ five-star Google reviews, provides estate and gift tax valuations meeting IRS requirements. Our engagements typically range from $7,500 to $25,000 depending on business complexity, with comprehensive reports supporting Form 709 (gift tax) and Form 706 (estate tax) filings.

Estate planning valuations serve several critical functions. Gift tax returns require fair market value determination when transferring business interests. Estate tax calculations at death depend on date-of-death valuations. Buy-sell agreement funding relies on accurate business values for life insurance and redemption planning. Equalization among heirs requires understanding relative values when businesses pass to some children while others receive different assets.

The IRS examines estate and gift valuations carefully, particularly for closely-held businesses where owners control both the transfer and the reported value. Qualified appraisals by credentialed valuators-holding designations like ABV (Accredited in Business Valuation) or ASA (Accredited Senior Appraiser)-provide substantial protection against IRS challenges. Sofer Advisors’ dual credentials satisfy IRS requirements while our 15+ years of experience ensures defensible conclusions.

How Does the IRS Value Businesses for Estate Tax?

The IRS applies fair market value standards defined in Treasury Regulations as the price at which property would change hands between a willing buyer and willing seller, neither being under compulsion and both having reasonable knowledge of relevant facts. This hypothetical transaction framework guides all estate and gift tax valuations.

| Valuation Approach | IRS Application | Key Considerations |

|---|---|---|

| Income Approach | Capitalizes earnings or discounts cash flows | Requires normalized earnings, appropriate rates |

| Market Approach | Compares to similar transactions/companies | Guideline companies, transaction multiples |

| Asset Approach | Values underlying assets individually | Holding companies, asset-intensive businesses |

Revenue Ruling 59-60 provides the foundational guidance valuators and the IRS follow when valuing closely-held businesses. The ruling identifies eight factors for consideration: nature and history of the business, economic outlook, book value, earning capacity, dividend-paying capacity, goodwill and intangibles, prior stock sales, and market prices of comparable companies. Professional appraisers address each factor in comprehensive reports.

The IRS maintains specialized Business Valuation Engineers who review reported values on estate and gift tax returns. These specialists identify aggressive positions, inadequate documentation, and methodology flaws. Professional valuations by qualified appraisers-following established fair market value principles-withstand this scrutiny better than informal estimates or book value approaches.

What Valuation Discounts Apply to Family Business Transfers?

Valuation discounts represent one of the most valuable-and scrutinized-aspects of estate planning for closely-held businesses. Properly supported discounts can reduce taxable transfer values by 25-45%, creating substantial tax savings for Georgia families transferring business interests.

| Discount Type | Typical Range | Basis | IRS Scrutiny Level |

|---|---|---|---|

| Lack of Control (DLOC) | 15% – 30% | Minority cannot control operations | Moderate |

| Lack of Marketability (DLOM) | 20% – 35% | No ready market for private shares | High |

| Combined Discounts | 25% – 45% | Multiplicative application | Very High |

Lack of control discounts (DLOC) reflect that minority interests cannot unilaterally control business decisions-hiring, firing, dividends, liquidation, or sale. A 30% ownership stake differs meaningfully from controlling interest because the minority holder depends on majority cooperation for any value realization. Courts and the IRS generally accept well-supported DLOC ranging from 15-30%.

Lack of marketability discounts (DLOM) recognize that private company shares cannot be sold on public exchanges. Selling minority interests in closely-held businesses requires finding qualified buyers, negotiating terms, and accepting illiquidity risk. Studies of restricted stock transactions and pre-IPO studies support DLOM typically ranging 20-35%, though the IRS challenges aggressive positions vigorously.

David Hern CPA ABV ASA, founder of Sofer Advisors, notes that discount support documentation has become increasingly important as the IRS challenges aggressive positions. Comprehensive discount analysis examining specific company characteristics, governing document restrictions, and empirical studies provides the foundation for defensible conclusions. Generic discount claims without company-specific support invite IRS adjustment.

How Can Gifting Business Interests Reduce Estate Taxes?

Strategic gifting of business interests during life can substantially reduce estate tax exposure while transferring wealth to the next generation. Georgia business owners benefit from understanding available techniques and their valuation implications.

Key strategies for tax-efficient business interest transfers:

- Annual exclusion gifts: $18,000 per recipient (2024) without using lifetime exemption

- Lifetime exemption gifts: Transfers exceeding annual exclusion reduce estate exemption

- Grantor retained annuity trusts (GRATs): Transfer appreciation while retaining income stream

- Intentionally defective grantor trusts (IDGTs): Sale to trust freezes estate value

- Family limited partnerships: Create entities enabling discounted transfers

- Installment sales: Spread gain recognition while removing appreciation from estate

Each technique requires proper valuation at transfer date. Gift tax returns (Form 709) must report fair market value of transferred interests, including applicable discounts. The three-year statute of limitations for gift tax assessment makes timely, well-documented valuations essential for planning certainty. Review our estate tax valuation guide for detailed planning considerations.

The current high exemption amounts-over $13 million per individual, $26 million per married couple-create unprecedented planning opportunities. However, the exemption is scheduled to revert to approximately $7 million (indexed) after 2025 unless Congress acts. Georgia business owners with substantial business value should consider accelerating transfers before potential exemption reduction.

How Do Buy-Sell Agreements Affect Estate Valuations?

Buy-sell agreements can establish business value for estate tax purposes, but only when meeting specific IRS requirements. Understanding these rules helps Georgia business owners structure agreements that provide both succession planning and tax benefits.

For buy-sell agreements to fix estate tax value, they must meet IRC Section 2703 requirements: the agreement must be a bona fide business arrangement, not a device to transfer property to family members for less than adequate consideration, and terms must be comparable to similar arm’s-length arrangements. Family agreements face heightened scrutiny and often fail to satisfy these requirements.

Even agreements not binding for estate tax purposes provide planning value. They establish mechanisms for ownership transfer, fund liquidity through life insurance, and create frameworks for family succession. Understanding buy-sell agreement structures helps owners balance tax planning with succession objectives.

Formula-based pricing in buy-sell agreements often produces values that diverge from fair market value over time. Agreements setting value at book value or fixed multiples may significantly understate or overstate actual worth. Periodic valuation updates-at least every three to five years-ensure agreement values remain reasonable and defensible.

What Triggers IRS Audit on Business Estate Valuations?

Understanding IRS audit triggers helps Georgia business owners prepare defensible valuations and avoid positions that invite examination. While audit selection involves multiple factors, certain characteristics increase scrutiny likelihood.

Common IRS audit triggers for business estate and gift valuations:

- Aggressive discounts: Combined discounts exceeding 40-45% without exceptional support

- Inadequate documentation: Missing appraisal reports or unqualified appraisers

- Inconsistent positions: Values differing significantly from prior valuations or financial statements

- Family limited partnerships: Structures primarily serving tax avoidance without business purpose

- Deathbed transfers: Significant gifts shortly before death raising substance questions

- Large estates: Higher value estates receive proportionally more IRS attention

- Prior audit history: Previous valuation disputes increase future examination probability

Professional valuations by qualified appraisers significantly reduce audit risk and improve outcomes when examinations occur. The IRS presumes qualified appraisals represent good faith value determinations, shifting burden to the Service to prove different values. Sofer Advisors’ dual credentials (ABV and ASA) and comprehensive documentation provide the defense Georgia families need.

Frequently Asked Questions

Do I need a business valuation for estate planning in Georgia?

Professional valuation is essential when business interests represent significant estate value, you’re making gifts requiring Form 709, establishing or updating buy-sell agreements, or creating succession plans involving unequal distributions. The IRS requires qualified appraisals for non-publicly traded business interests. Informal estimates invite IRS challenges and potential penalties.

How does the IRS value a business for estate tax?

The IRS applies fair market value standards under Revenue Ruling 59-60, examining eight factors including earning capacity, book value, and comparable sales. They employ Business Valuation Engineers who review reported values. Income, market, and asset approaches may apply depending on business characteristics. Qualified appraisals receive presumptive acceptance.

What discounts apply to family business transfers?

Minority interest discounts (lack of control) typically range 15-30%, reflecting inability to control business decisions. Marketability discounts range 20-35%, recognizing private shares lack ready markets. Combined discounts of 25-45% are supportable with proper documentation. Aggressive discounts invite IRS scrutiny; company-specific analysis strengthens positions.

How often should I update my estate planning valuation?

Update valuations every three to five years or when material changes occur-significant revenue changes, new products, acquisitions, key employee departures, or economic shifts. Dated valuations may not reflect current value for planning purposes. Buy-sell agreement values particularly require periodic review to ensure continued reasonableness.

What’s the difference between fair market value and book value?

Fair market value represents hypothetical transaction price between willing parties-the IRS standard for estate and gift taxes. Book value reflects accounting equity from historical cost basis, often significantly understating actual worth. Using book value for tax reporting invites IRS adjustment and potential penalties. Professional appraisals determine fair market value.

Can I gift business interests to reduce estate taxes?

Yes. Strategic gifting during life removes asset value and future appreciation from your estate. Annual exclusion gifts ($18,000 per recipient in 2024) require no exemption use. Larger gifts use lifetime exemption but freeze values. Discounted transfers amplify benefits-a 35% discounted gift transfers more value per exemption dollar used.

How do valuation discounts work for minority interests?

Minority interest discounts reduce taxable value because partial ownership lacks control and marketability. A 30% interest in a $10 million company isn’t worth $3 million-the minority holder can’t force dividends, sale, or liquidation. Discounts quantify this value reduction. Combined control and marketability discounts typically range 25-45%.

What documentation does the IRS require for business gift tax returns?

IRS requires qualified appraisals for non-publicly traded business interests exceeding $10,000. Appraisals must include appraiser qualifications, valuation date, methodology description, and fair market value conclusion. Form 709 must report value and include appraisal summary. Inadequate documentation triggers penalties and invites audit.

How do buy-sell agreements affect estate valuations?

Buy-sell agreements can fix estate tax value if meeting IRC Section 2703 requirements: bona fide business arrangement, not a device to transfer below value, and comparable to arm’s-length terms. Family agreements face heightened scrutiny. Even non-binding agreements provide planning value for succession and liquidity purposes.

Should my estate attorney and valuator work together?

Absolutely. Coordinated planning between estate attorneys and valuators optimizes outcomes. Attorneys structure transfers; valuators determine defensible values. Understanding valuation before structuring helps attorneys select appropriate techniques. Valuators benefit from knowing planned structures. This collaboration produces integrated plans maximizing tax efficiency.

What triggers an IRS audit on business estate valuations?

Common triggers include aggressive discounts exceeding 40-45%, inadequate appraisal documentation, inconsistent positions versus prior valuations, family limited partnerships lacking business purpose, deathbed transfers, large estate values, and prior audit history. Professional appraisals by qualified appraisers reduce audit probability and improve outcomes.

How far in advance should I get a valuation for estate planning?

Begin valuation 3-6 months before planned transfers to allow thorough analysis and coordination with attorneys. For year-end gifts, initiate valuations by September. Rush engagements cost more and may compromise quality. Estate planning is ongoing-establish baseline valuations early, then update periodically as circumstances change.

Conclusion

Estate planning business valuation in Georgia requires understanding IRS fair market value requirements, available discounts, and documentation standards that create defensible positions. The stakes are significant-proper valuation can save hundreds of thousands in transfer taxes while avoiding costly IRS disputes.

With the current high exemption amounts potentially decreasing after 2025, Georgia business owners face a narrowing window for tax-efficient wealth transfer. Professional valuation establishes the foundation for strategic gifting, trust planning, and succession strategies that maximize family wealth preservation.

Sofer Advisors provides comprehensive estate and gift tax valuations throughout Georgia, backed by 180+ five-star Google reviews and dual credentials satisfying IRS qualified appraiser requirements. Our defensible valuations support tax-efficient wealth transfer while minimizing audit risk.

SCHEDULE A CONSULTATION: Contact us to discuss your Georgia estate planning valuation needs and protect your family’s wealth transfer strategy.

This article provides general information for educational purposes only and does not constitute legal, tax, financial, or professional advice-consult qualified professionals regarding your specific circumstances.

People Also Read

- “estate tax valuation” → Link to: Closely Held Business Valuation for Estate Tax: Atlanta Guide

- “gift tax returns” → Link to: Gift Tax Business Valuation: Complete Compliance Guide

- “family succession” → Link to: Strategic Succession: Family Business Buyouts Guide