What is a DCF Valuation? Complete Guide to DCF Method

A DCF valuation is a financial analysis method that determines a business’s fair market value by projecting future cash flows and discounting them to present value using the weighted average cost of capital. This income approach provides business owners with objective insight into their company’s true worth based on its ability to generate sustainable earnings over time. DCF analysis forms the foundation for critical business decisions including mergers and acquisitions, succession planning, and strategic transitions.

Business owners frequently turn to DCF valuations when they need defendable analysis for buy-sell agreements, estate planning, or litigation support. David Hern CPA ABV ASA and the team at Sofer Advisors have completed hundreds of DCF analyses across multiple industries, helping family-owned and closely-held companies understand where their business stands today and where it can go tomorrow. The methodology transforms financial projections into actionable insights that guide ownership transitions and capital strategy decisions.

How does the DCF valuation method work?

The discounted cash flow method operates on the fundamental principle that a business’s value equals the present worth of all future cash flows it will generate. This income approach begins with detailed financial projections, typically spanning five to ten years, followed by a terminal value calculation representing cash flows beyond the projection period.

Core DCF Valuation Components:

- Historical financial analysis and earnings normalization

- Cash flow projections spanning five to ten years

- Weighted average cost of capital (WACC) calculation

- Terminal value representing cash flows beyond projection period

- Risk adjustments for company size, industry, and key person dependence

Business valuation professionals start by analyzing historical financial performance and earnings normalization adjustments. These adjustments remove one-time expenses, excessive owner compensation, and non-operating items to reveal the company’s true earning capacity. The normalized earnings provide the foundation for projecting sustainable cash flows going forward.

Next, analysts apply appropriate discount rates reflecting the investment’s risk profile. The weighted average cost of capital incorporates both equity and debt costs, adjusted for factors like company size, industry volatility, and key person dependence. Smaller businesses often require higher discount rates due to increased risk compared to public companies.

The terminal value calculation captures the business’s worth beyond the projection period, typically using either a perpetual growth model or exit multiple approach. This component often represents 60-80% of total enterprise value, making accurate terminal value assumptions critical for reliable results.

What does a DCF analysis tell business owners?

DCF analysis reveals whether your business creates genuine economic value above its cost of capital. Unlike simple earnings multiples, the discounted cash flow method examines your company’s fundamental cash-generating ability and sustainable competitive advantages. This analysis helps identify specific value drivers that impact your business worth most significantly.

The methodology highlights timing differences between accounting profits and actual cash generation. Many profitable businesses struggle with working capital management or heavy capital expenditure requirements that reduce available cash flow. DCF analysis exposes these dynamics, showing how operational improvements can enhance enterprise value.

Business owners gain insight into optimal capital allocation decisions through DCF sensitivity analysis. By testing different growth scenarios, margin assumptions, and capital investment levels, you can identify which strategic initiatives generate the highest returns. This guidance proves invaluable for succession planning and exit strategy development.

DCF valuations also establish benchmarks for performance measurement and management compensation structures. When your business maintains detailed cash flow projections, you can track actual results against expectations and adjust strategies accordingly. This disciplined approach helps transform valuation from a scorecard into a roadmap for value creation.

Why do professionals consider DCF the most reliable valuation method?

The discounted cash flow approach directly measures a business’s fundamental value-creating capacity rather than relying on market comparisons that may not reflect current conditions. Unlike market approach methods that depend on comparable company transactions, DCF analysis focuses on your specific business’s cash-generating ability and growth prospects.

Professional standards from the American Society of Appraisers and AICPA Statement on Standards for Valuation Services recognize DCF as a primary income approach method. Courts frequently accept DCF valuations in litigation contexts because the methodology provides logical, step-by-step analysis that parties can examine and understand.

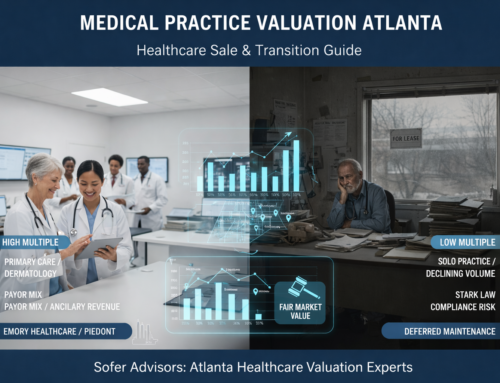

DCF analysis accommodates unique business characteristics that market multiples cannot capture effectively. Companies with unusual capital structures, growth trajectories, or operational models require customized analysis that only the income approach provides. This flexibility makes DCF particularly valuable for family-owned businesses and closely-held companies.

The methodology also enables comprehensive risk assessment through discount rate adjustments and scenario modeling. Business appraisers can quantify specific risk factors like customer concentration, management dependence, or industry cyclicality within the valuation framework. This granular analysis helps business owners understand which risks impact value most significantly.

When should business owners request DCF valuations?

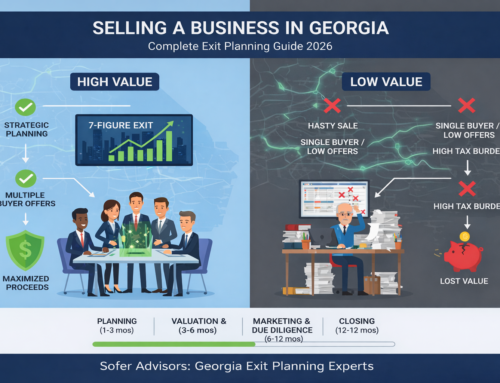

Business owners typically need DCF analysis for ownership transitions including management buyouts, family succession transfers, or third-party sales. The income approach provides objective fair market value conclusions required for buy-sell agreement triggers and estate planning purposes. These situations demand rigorous independent valuations that can withstand potential challenges.

Tax compliance situations frequently require DCF analysis to support gift and estate tax returns filed with the IRS. Revenue Ruling 59-60 specifically references earning capacity as a key valuation factor, making the income approach essential for tax reporting. Business owners benefit from working with credentialed professionals who understand IRS valuation standards and can provide defendable analysis.

Litigation contexts including shareholder disputes, divorce proceedings, and business interruption claims often rely on DCF methodology. Expert witness testimony requires detailed support for value conclusions, and the income approach provides logical framework that courts can evaluate. Sofer Advisors has provided expert witness testimony in 9+ cases across multiple jurisdictions, defending DCF analyses under cross-examination.

Strategic planning initiatives also benefit from DCF analysis to evaluate acquisition opportunities, capital investment decisions, and operational improvements. Business owners can model different scenarios to understand how various strategies impact enterprise value and stakeholder returns.

What factors impact DCF valuation accuracy?

Key Factors Affecting DCF Accuracy:

- Financial projection quality and realistic growth assumptions

- Appropriate discount rate selection reflecting company-specific risks

- Terminal value methodology and long-term growth rates

- Earnings normalization adjustments for owner compensation and one-time items

- Professional judgment and industry expertise in applying methodology

Financial projection quality represents the most critical factor affecting DCF reliability. Accurate cash flow forecasts require deep understanding of industry dynamics, competitive positioning, and company-specific operational drivers. Business owners should work with valuation professionals who invest time in comprehensive discovery and diligence phases.

Discount rate selection significantly influences value conclusions, particularly for smaller businesses that carry higher risk premiums. Appropriate risk assessment requires analysis of company size, financial leverage, customer concentration, management depth, and industry volatility. Professional appraisers maintain subscriptions to multiple databases to support risk premium calculations.

Terminal value assumptions can materially impact results since this component often represents the majority of total value. Conservative growth assumptions and appropriate exit multiples help ensure realistic value conclusions. Experienced business appraisers test terminal value sensitivity to validate reasonableness.

Earnings normalization adjustments require careful analysis to avoid overstating sustainable cash flows. One-time benefits, below-market compensation arrangements, and related party transactions need appropriate treatment. Professional judgment and industry experience become essential for accurate normalization.

How long does a professional DCF valuation take?

Comprehensive DCF analysis typically requires 4-6 weeks from data collection through final report delivery, depending on business complexity and information availability. Sofer Advisors maintains a next business day response policy and completes valuations on time every engagement through structured project management processes. Professional DCF valuations typically cost $7,500 to $25,000 depending on business complexity, projection requirements, and engagement scope.

The discovery phase involves detailed financial analysis, management interviews, and industry research that establishes the foundation for reliable projections. This upfront investment in understanding your business ensures accurate cash flow modeling and appropriate risk assessment. Rush assignments often compromise quality and may not withstand scrutiny.

Data collection efficiency significantly impacts timeline, making organized financial records essential. Business owners can expedite the process by providing clean financial statements, management reports, budgets, and strategic plans in electronic format. Professional valuation firms utilize secure client portals like Suralink to streamline document exchange.

Report preparation includes extensive quality control reviews and technical compliance checks. Credentialed appraisers must ensure adherence to professional standards including Uniform Standards of Professional Appraisal Practice and maintain appropriate documentation supporting all conclusions.

Conclusion

DCF valuation provides business owners with the most direct measure of their company’s fundamental worth—grounded in cash-generating capacity rather than generic market multiples. Whether you’re preparing for a sale, structuring a buy-sell agreement, supporting estate planning, or resolving shareholder disputes, defensible DCF analysis forms the foundation for confident decision-making.

Sofer Advisors—backed by 180+ five-star Google reviews and Inc. 5000 recognition—brings deep expertise in DCF methodology across multiple industries, helping family-owned and closely-held businesses transform complex financial analysis into actionable insights. Our team maintains the credentials, database subscriptions, and courtroom experience to deliver valuations that withstand scrutiny.

SCHEDULE A CONSULTATION to discuss your DCF valuation needs.

Frequently Asked Questions

What is the discounted cash flow valuation method?

The discounted cash flow valuation method determines business worth by projecting future cash flows and converting them to present value using appropriate discount rates. This income approach analyzes a company’s fundamental earning capacity rather than relying on market comparisons. Professional appraisers use DCF analysis to provide objective fair market value conclusions for ownership transitions, tax compliance, and litigation support purposes.

What is discounted cash flow in simple terms?

Discounted cash flow represents the present value of money your business will generate in the future, adjusted for risk and time. Think of it as asking what someone would pay today for the right to receive all future cash flows from your business operations. The analysis accounts for uncertainty by applying higher discount rates to riskier businesses, resulting in lower present values for the same projected cash flows.

What does a DCF tell you?

A DCF analysis reveals whether your business creates economic value above its cost of capital and identifies specific value drivers that impact worth most significantly. The methodology shows how operational improvements, growth strategies, and capital allocation decisions affect enterprise value. Business owners gain insight into optimal timing for ownership transitions and strategic initiatives that maximize stakeholder returns through comprehensive cash flow modeling.

Why is DCF the best valuation method?

DCF analysis provides the most direct measure of business value because it focuses on fundamental cash-generating capacity rather than market comparisons that may not reflect current conditions. Professional standards recognize the income approach as primary methodology for unique businesses that lack comparable transactions. Courts frequently accept DCF valuations because the step-by-step analysis provides logical framework that parties can examine and understand during disputes.

How accurate are DCF valuations?

DCF accuracy depends on projection quality, appropriate risk assessment, and professional judgment in applying methodology. Experienced business appraisers achieve reliable results by conducting comprehensive discovery, utilizing multiple databases for risk premium support, and testing sensitivity across key assumptions. The methodology provides more accurate results than simple rule-of-thumb multiples because it considers company-specific characteristics and risk factors that impact value.

What discount rate should be used in DCF analysis?

Discount rates reflect the weighted average cost of capital adjusted for company-specific risk factors including size, leverage, customer concentration, and management dependence. Professional appraisers utilize multiple databases and methodologies to develop appropriate cost of equity and debt components. Smaller businesses typically require higher discount rates due to increased risk compared to public companies, often ranging from 15-25% depending on specific circumstances.

How do you calculate terminal value in DCF?

Terminal value represents cash flows beyond the projection period and typically uses either perpetual growth models or exit multiple approaches. The perpetual growth method applies modest long-term growth rates to final year cash flows, while exit multiples utilize industry transaction data. Professional appraisers test both approaches and select the method most appropriate for specific business circumstances and industry dynamics.

What are the limitations of DCF analysis?

DCF limitations include dependence on projection accuracy, sensitivity to discount rate assumptions, and difficulty quantifying intangible value drivers like brand recognition or customer relationships. The methodology works best for businesses with predictable cash flows and established operating histories. Startup companies or highly volatile industries may require supplemental valuation approaches to provide comprehensive value conclusions that address inherent uncertainties.

Should business owners attempt DCF analysis themselves?

Business owners benefit from understanding DCF concepts but should engage credentialed professionals for formal valuations used in ownership transitions, tax compliance, or litigation contexts. Professional appraisers maintain specialized knowledge of valuation standards, risk assessment methodologies, and court-accepted practices. DIY attempts often result in inaccurate conclusions that cannot withstand scrutiny when stakes are high and professional credibility matters.

How often should businesses update DCF valuations?

Businesses should update DCF valuations annually or when significant changes occur in operations, market conditions, or strategic direction. Buy-sell agreements may require periodic updates to ensure current fair market value conclusions. Regular valuation updates help business owners track progress against value creation goals and make informed decisions about timing for succession planning or strategic alternatives. Professional monitoring ensures compliance with changing regulatory requirements.

This content is for informational purposes only and does not constitute professional valuation advice. Business valuation conclusions depend on specific facts and circumstances. Contact Sofer Advisors for a consultation regarding your specific situation.